Momentum Index Funds Gain Popularity as Investors Embrace Factor Investing

Varahi media.com online news, India, March 7, 2025: Momentum investing is witnessing strong traction in India as interest in factor-based index funds continues to grow. The National Stock

Varahi media.com online news, India, March 7, 2025: Momentum investing is witnessing strong traction in India as interest in factor-based index funds continues to grow. The National Stock Exchange (NSE) now offers 31 factor-based indices, reflecting the increasing demand for such investment strategies from mutual funds.

Factor investing leverages key market drivers like momentum, low volatility, and value, enabling investors to gain exposure to stocks with characteristics that have historically influenced returns. The Nifty Midcap 150 Momentum 50 Index, for example, selects the top 50 stocks from the Nifty Midcap 150 based on their Normalized Momentum Score.

మహిళా దక్షత సమితి ఆధ్వర్యంలో “కుంభమేళా: శాస్త్రం & ఆధ్యాత్మికత” పై ఉపన్యాసం

Read this also…VP Jagdeep Dhankhar Urges Indian Corporates to Invest in Specialized Educational Institutions

Read this also…Gear Up for a Spy Action Thrill! Akhil Akkineni’s “Agent” Premieres on Sony LIV from March 14

Despite recent market corrections and volatility, momentum index funds have continued to attract investor inflows. Over the past four months, major stock indices have recorded negative returns, erasing all year-to-date gains. However, funds tracking the Nifty Midcap 150 Momentum 50 Index have remained resilient, drawing sustained investments.

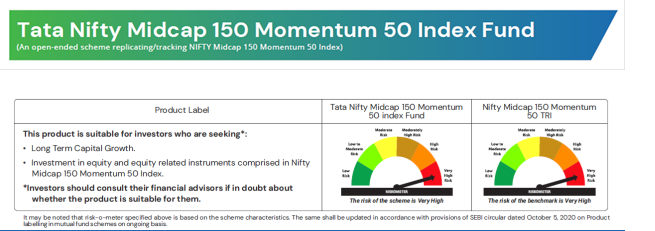

One such fund, the Tata Nifty Midcap 150 Momentum 50 Index Fund, highlights the growing popularity of momentum investing. In 2024, inflows into this fund tripled year-on-year to approximately ₹500 crore, with participation spanning 199 cities.

Notably, inflows from Delhi surged to over ₹27 crore in 2024, a sharp rise from ₹1.25 crore in 2023, while new PAN registrations increased from 15 to 169. Similar growth trends were observed in Kolkata, Bengaluru, and Chennai. (Source: Internal Data)

“Momentum investing helps investors capitalize on strong price trends while minimizing emotional biases. The Tata Nifty Midcap 150 Momentum 50 Index Fund offers a systematic approach to factor investing, balancing risk and potential rewards.

హాజరయ్యారు.

Read this also…Mahila Dakshata Samithi Organizes Enlightening Lecture on “Kumbh Mela: A Union of Science and Spirituality”

Read this also…‘Rewind’ Stars Sai Ronak & Amrutha Chowdary Share Their Experience in Upcoming Sci-Fi Romance

Given the resilience of midcap stocks, investors may consider this strategy for long-term portfolio growth,” said Anand Vardarajan, Head of Passive Investments at Tata Asset Management.

The fund, launched in October 2022, is managed by Kapil Menon.

As factor investing gains wider acceptance, momentum-based strategies like the Tata Nifty Midcap 150 Momentum 50 Index Fund provide an opportunity for investors to enhance portfolio diversification and optimize returns.