HDFC Balanced Advantage Fund Marks 32-Year Milestone with 18% CAGR..

365telugu.com online news,MUMBAI,February 11th,2026: HDFC Balanced Advantage Fund, one of India’s largest open-ended dynamic asset allocation funds, has completed 32 years of operation

365telugu.com online news,MUMBAI,February 11th,2026: HDFC Balanced Advantage Fund, one of India’s largest open-ended dynamic asset allocation funds, has completed 32 years of operation since its launch in February 1994. As of January 31, 2026, the fund manages assets totaling ₹1,06,820 crore, reflecting deep-seated investor trust in its hybrid investment strategy.

The fund has demonstrated its ability to navigate various market cycles—ranging from financial crises to market recoveries—delivering a compounded annual growth rate (CAGR) of approximately 18% since inception.

ఇదీ చదవండి..హైదరాబాద్లో భారీగా విస్తరించిన యూబిఎస్ (UBS)గచ్చిబౌలిలో నూతన కార్యాలయం ప్రారంభం…

Read this also:UBS Strengthens India Footprint with Major Expansion in Hyderabad..

The Power of Compounding: SIP Performance

The fund’s long-term performance highlights the significant wealth-creation potential of disciplined, long-term investing. According to the fund house:

Initial Investment: A monthly SIP of ₹10,000 started at the fund’s inception (February 1, 1994).

Read this also:Hyderabad Real Estate: January Home Registrations Dip 14%, High-Value Homes Hold 15% Market Share..

ఇదీ చదవండి..రూ.250 కోట్ల లక్ష్యంతో’ట్రూసిల్వర్’ లాంచ్!

Current Value: Grown to approximately ₹15.89 crore as of January 31, 2026.

Returns: This growth represents an internal rate of return (XIRR) of 18.40%.

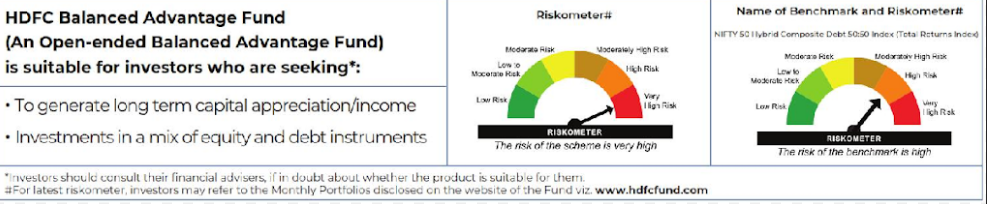

The fund’s dynamic asset allocation approach—shifting between equity and debt based on market conditions—aims to provide a balance of growth and stability, making it a preferred choice for investors concerned about market volatility and valuation.

Navneet Munot, MD & CEO of HDFC AMC, emphasized the importance of patience in wealth creation. “This milestone is a tribute to the trust of millions of investors. Our journey is anchored in robust processes and a consistent focus on delivering enduring long-term value,” he stated.

Gopal Agrawal, Senior Fund Manager at HDFC AMC, noted that the fund’s flexible approach helps investors stay on track. “The fund aims to maintain a careful balance between growth opportunities and risk management to deliver better outcomes across different market conditions,” Agrawal added.